Tower, this is The Departure Times 001, radar contact.

Or, I could just simply say: Hello, dear readers,

Welcome to the first edition of The Departure Times, a fun-to-read weekly newsletter on aviation and travel tech.

I’m Máté, the creator of this newsletter.

But why me? Why this? Why now?

Why me?

I’ve been an aviation geek since I was a teenager. I’ve been working in the travel tech sector for 6+ years. Before I started my professional career, I wrote articles for an aviation & travel news site for years.

Why this?

To combine my love for writing and aviation into one love product.

Avgeek + Writing = The Departure Times. That simple.

Why now?

Now or never, as they say. Jokes aside, I’m a huge believer in newsletters. Email is not dead yet, as many have been saying for years.

Newsletters are booming.

You can get all the important news, developments, stories, and more, directly in your email inbox.

And so, while there are a handful of aviation and travel tech-related newsletters out there, I felt the need for one that’s fun to read, filled with insightful and entertaining briefings, stories, and thoughts.

Because even if we work in a serious industry, we don’t always have to take ourselves seriously.

So roll up your sleeves, take your cup of coffee, and check the time, because we are ready for boarding on this first edition of The Departure Times!

This week, you can read about:

🇭🇺 The Budapest Airport takeover saga

🤝🏻 Another Ryanair-OTA agreement

🤪 The best airline April Fools’ social media content

It’s only a 10-min read.

Before we dive in, subscribe to get a piece of The Departure Times in your inbox every week.

THIS WEEK’S TOP STORY

The saga of the Budapest Airport takeover is far from being over

The SkyCourt Departure Hall at Budapest Airport. Source: Budapest Airport

Hungary’s main international airport has been in private hands since 2005. Initially, only 75% of ownership was privatized but in 2012, the government sold the remaining 25% of the stakes.

This may change soon if the Hungarian government’s intentions come true.

It was first reported in October 2020 that a Hungarian consortium sought to buy Budapest Airport from its current owners but this attempt failed. Not long after, in May 2021, the government-friendly media reported that PM Viktor Orbán’s cabinet intends to buy back the airport.

And while the owners rejected the first offer - that reportedly was lower than market value - and then, Orbán postponed the takeover attempts due to budget risk, the government did not give up.

Two years later, in April 2023, the Minister for National Economy claimed that the takeover of Budapest Airport could be finalized before the year ended.

Well, the year ended but it wasn’t finalized. The Q1 of 2024 is over and we haven’t heard much updates.

So what’s going on with the Budapest Airport takeover?

First, let’s review all that we know.

The current ownership structure:

Airport Holding Ltd. is the operating company of Budapest Airport. Its ownership structure is the following:

55.44%: AviAlliance (owned by PSP Investments of Canada)

23.33%: Malton (owned by GIC, the sovereign wealth fund of Singapore)

21.23%: Quebec Deposit and Investment Fund

The planned ownership structure:

The initial idea was that the Hungarian state would purchase 51% ownership and Vinci Airports would take over the remaining 49%, while also receiving management rights.

Later, media reports said that a third stakeholder would be involved in the final takeover and therefore, the ownership structure may be the following:

51%: Hungarian state (through the state-owned Corvinus International Investment Plc)

29%: Qatar Investment Authority

20%: Vinci Airports

But it’s only a speculation yet, it cannot be ruled out that the takeover won’t be a simple sale of shares but the deal could be linked to the construction project of Terminal 3.

The takeover price:

According to media reports, the deal will be for €4bn, including the takeover of a €1.5bn debt liabilities.

It means that the price tag for the Hungarian state will end at €2bn. Unless there’s a different agreement with Vinci Airports.

The Hungarian Ministry of National Economy already transferred €848.8m to the accounts of Corvinus, the state-owned investment company, and according to the Minister, the remaining amounts will be financed by a state development bank and another state-owned bank.

The challenges around this takeover

The Hungarian government has been facing certain challenges along the way. These are:

Funding the deal: the state budget is not in its best shape. But that doesn’t stop the government from this acquisition. Lack of funding seemed to be a headache but through the sale of certain state-owned assets (e.g. stakes in Erste Bank and Yettel telecommunication company), the money is right there.

STATUS: SOLVED ✅The disputes on management rights: initially, it was clear that Vinci Airports would receive the management rights. But reports said that due to govt-linked businesspeople’s pressure, the state is reluctant to handle the airport’s operational management to Vinci.

STATUS: UNKNOWN ❓More debt liabilities unveiled: as it turns out, Airport Holding Ltd.’s subsidiary has debt obligations to its parent company and the Hungarian state agreed to take over these debt obligations and to provide additional funds to the subsidiary.

According to the latest report by the Hungarian news site 444, the Ministry’s negotiators failed to agree in advance on these debt liabilities, resulting in the takeover of those debt obligations. Therefore, more funds are needed for the transaction by the Hungarian state.

STATUS: UNKNOWN ❓The Qataris: we still don’t know much about the progress with the involvement of the Qatar Investment Authority in this deal. The Qataris may want a high-level Prime Ministerial meeting to approve the deal. The only hiccup is that Hungarian PM Orbán said in December that the whole airport takeover is already “a done deal”.

STATUS: UNKNOWN ❓The current owners’ negotiation power: AviAlliance and the other stakeholders have the power to negotiate on better terms. This may have resulted in the state’s takeover of the subsidiary debt obligations as well.

STATUS: UNKNOWN ❓

The interior of Pier 1, built for intra-Schengen low-cost flights. Source: Budapest Airport

As you see, there are still certain challenges along the way but since they are all happening in the background, the timeline for closing the deal is unknown yet.

It may happen any day, even “before the summer”, as the Hungarian Minister of National Economy claimed.

Two things are for sure:

The Hungarian government will not back off. No matter what it takes.

Budapest Airport is a hot piece of asset and based on the annual traffic numbers, route developments, and investments made, it’s just getting better.

Two key things are unsure:

How would this potential takeover impact the development plans of Budapest Airport, including Terminal 3 and passenger experience improvements? Will it finally escalate the construction of rail connectivity from Budapest to the airport?

Would the current management stay in place? Budapest Airport has key executive figures, working at the airport for 10+ years (including the CEO and CCO), who know the airport in and out.

Hopefully, we can get answers to these questions soon.

NEWS BRIEFS

JetBlue introduces dynamic pricing for first checked bags

Photo by Sachin Amjhad on Unsplash

JetBlue is fighting its way back to profitability and therefore, the airline took another measure to achieve that by introducing dynamic pricing for its checked bags.

Such a pricing strategy is already in place for ULCCs, like Ryanair or Frontier. But for JetBlue, it’s less complicated from a passenger perspective.

JetBlue now differentiates bag fees for peak and off-peak seasons and keeps differentiating fees for transatlantic routes and their U.S., LatAm, Caribbean, and Canada flights.

From the airline’s economic perspective, it’s a wise move. Supply meets demand, right?

Since JetBlue failed to acquire Spirit in an all-cash deal, it’s forced to focus on optimizing operations and profitability. Reducing capacity, alongside the new bag pricing strategy is also a part of their loss-reduction efforts.

Source: CNN

A wild week in corporate travel acquisitions: Direct Travel has been acquired, CWT will be

Concur’s co-founder Steve Singh has acquired Direct Travel, a corporate travel management specialist. Singh is joined by a group of investment firms in this acquisition. The deal was announced yesterday without the exact deal size.

Direct Travel currently has a $300m annual revenue that Singh wants to grow 10%, 15%, and 20% YoY over the next years. The company is mainly focusing on the UK and North America with its operations.

Last week, another major acquisition shed light, as American Express GBT announced that it’s acquiring CWT, a major business travel and meetings solutions provider in the corporate travel industry.

The deal is valued at $570m and expected to be finalized in H2 2024, subject to regulatory approvals and other conditions.

Source: Direct Travel & Amex GBT

Another OTA surrender agreement: eSky partners up with Ryanair

Ryanair vs. OTAs: 6:0

Another OTA has signed an agreement with Ryanair. This time it’s the Poland-based eSky, one of the largest online travel agencies in Central Europe.

As we all know, Ryanair has been fighting a war with the OTAs for a long time and it seems the airline is winning.

Ryanair has been labeling OTAs as “pirates” and “scams” for selling their flight tickets “unauthorized”.

Therefore, they also introduced new measures to crack down on those OTAs, including passenger verification on Ryanair’s website for all bookings made via a third-party provider.

While OTAs certainly marked up certain airline ancillaries, including baggage fees, in many cases, some OTAs also slightly undercut Ryanair’s fares to attract customers.

This certainly worked, until Ryanair’s efforts to completely block OTAs’ web scraping activities. This was the “final nail in the coffin” that forced all parties to (re-)start the agreement negotiations.

While according to the press release, this eSky-Ryanair deal may be a “win for everyone”, I’m sure it’s a slightly bitter peace deal for the OTA.

One thing is for sure: passengers may now benefit from eSky’s holiday bundle offers that could include Ryanair flights as well.

Source: Ryanair

FAVORITE READS

My weekly “inflight food” for thought

📱 For Ryanair’s social media team, there are only two taboos: security and the death of the Queen. Everything else is on the table. Skift’s article explores how Ryanair’s social media accounts became actually fun.

🇿🇦 Kirby Gordon, FlySafair’s CMO wrote about how jet fuel prices bring massive challenges to the South African airline market.

🌍 YouTuber Noel Philips had a “bizarre” flight on Turkmenistan Airlines with a layover at the fancy but empty Ashgabat Airport. Check out his video after work (but don’t watch it during dinner, have some time with your loved ones).

SOCIAL MEDIA CONTENT OF THE WEEK

The Best Airline April Fools’ Content

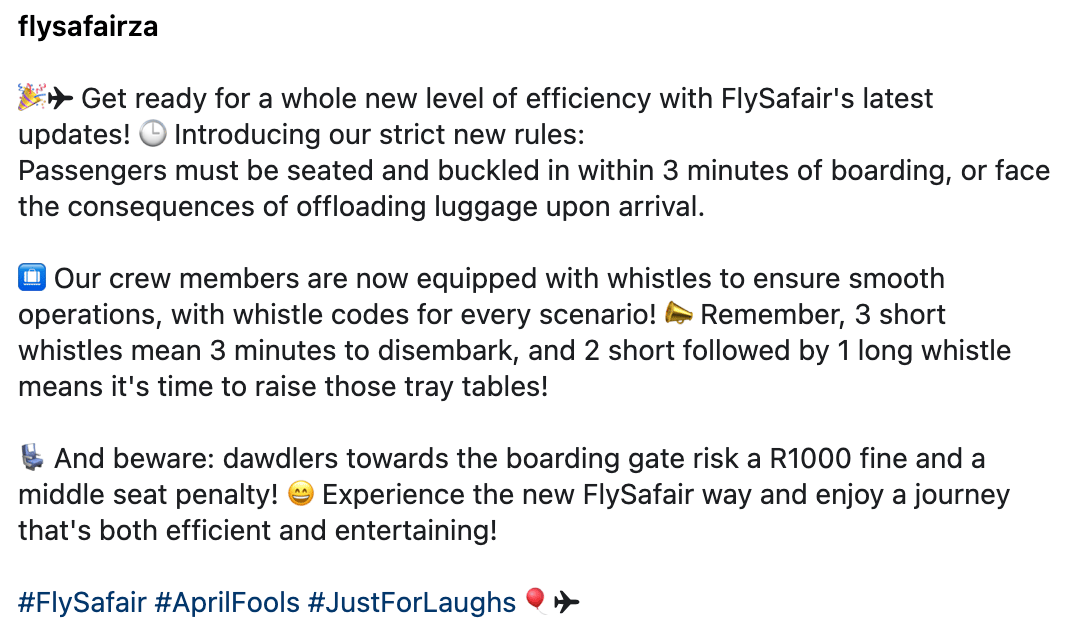

Some airlines brought some fun but expected content for April Fools’ Day.

Like Frontier, which “announced” its new long-haul services to Bora Bora. Good one. Or Wizz Air, which “unveiled” its updated brand named R!ZZ. Generation Z certainly loved it.

But for me, FlySafair certainly won this contest. They “announced” their new 3-minute boarding policy. Certainly, something most of us would love to see. But until this becomes a reality, cheers to the “last call” boarding! 😎

Do you enjoy reading this newsletter?

If so, please share it with others so they also get a piece of The Departure Times every week.

Thanks for being here.

See you next week!

Máté Bence Tóth

Aviation Geek

B2B Content Writer

Sales & Partnership Manager Experience in the Travel Industry

Hey, I’m Máté, the creator of The Departure Times.

I have three great passions: aviation, travel, and writing.

I love combining these passions to create great things that can reach the sky (cheesy pun intended).

I can help your business ascend by creating attractive written content.

If you want to work with me, let’s have a chat.